bear trap stock term

Dont take a short position. In general a bear trap is a technical trading pattern.

What Is A Bear Trap On The Stock Market Fx Leaders

A Bear Trap in terms of trading is a strategy that institutions use to take advantage of the young traders that dont have the insight to recognise when they are being played.

. Bear traps spring as brokers initiate margin calls against investors. Invest in Direct Mutual Funds New Fund Offer NFO Discover 5000 schemes. Price Action Suggests Near-Term Bottom But No Bear Trap Yet DIS price chart TradingView DIS stock had two massive bull traps that.

In bear traps there is a general expectation that the market is going to fall. Earnings per share EPS Beta. A bear trap is a condition in the market where the expected downward movement of prices suddenly reverses up.

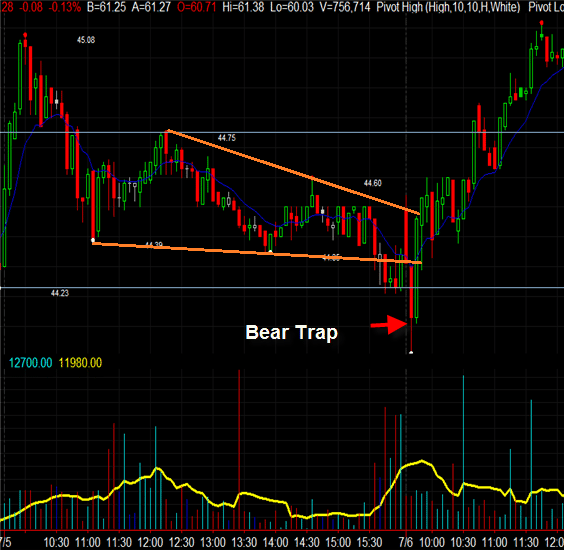

A bear trap or bear trap pattern is a sudden downward price movement luring bearish investors to sell an investment short followed by a price reversal back upward. If youre thinking about short-selling or have done any research you might have heard the term bear trap. However in this context the term is used to describe both the technique and the specific technical indication of a reversal in a market downtrend.

When this happens anyone who was betting on the stock to go down ends up losing money even if the. The creation of a bear trap involves the careful planning and execution of a set of circumstances in which there is sense of an impending short term fall in the price of a given security that will be followed by a long term upswing in the price. But it returned from down there and pierced the support level.

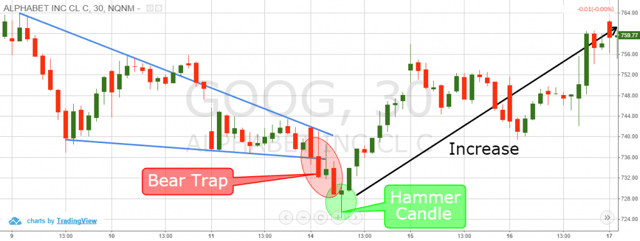

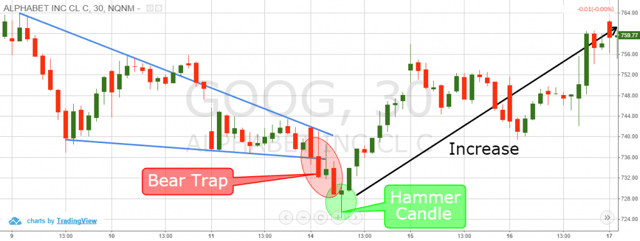

A good example of a bear trap can be found on the chart below. Rising stock prices cause losses for bearish investors who are now trapped. The simplest way to avoid getting caught in a bear trap is to avoid taking short positions altogether.

An A to Z Guide to Investment Terms for Todays Investor by David L. Use a different trading strategy. Bear Trap Stock is a term used in the stock market to describe a particular type of investment.

This phenomenon and market performance lure many traders in investing and buying in the market. Track your portfolio 24X7. This causes traders to open short positions with expectations of profiting from the assets price decline.

Alternatively it may cause them to sell off their stock or cryptocurrency assets in order to take profits and prevent losses. It consists of creating a false signal in the market indicating that an asset is going to start losing its value. Short sellers lose money.

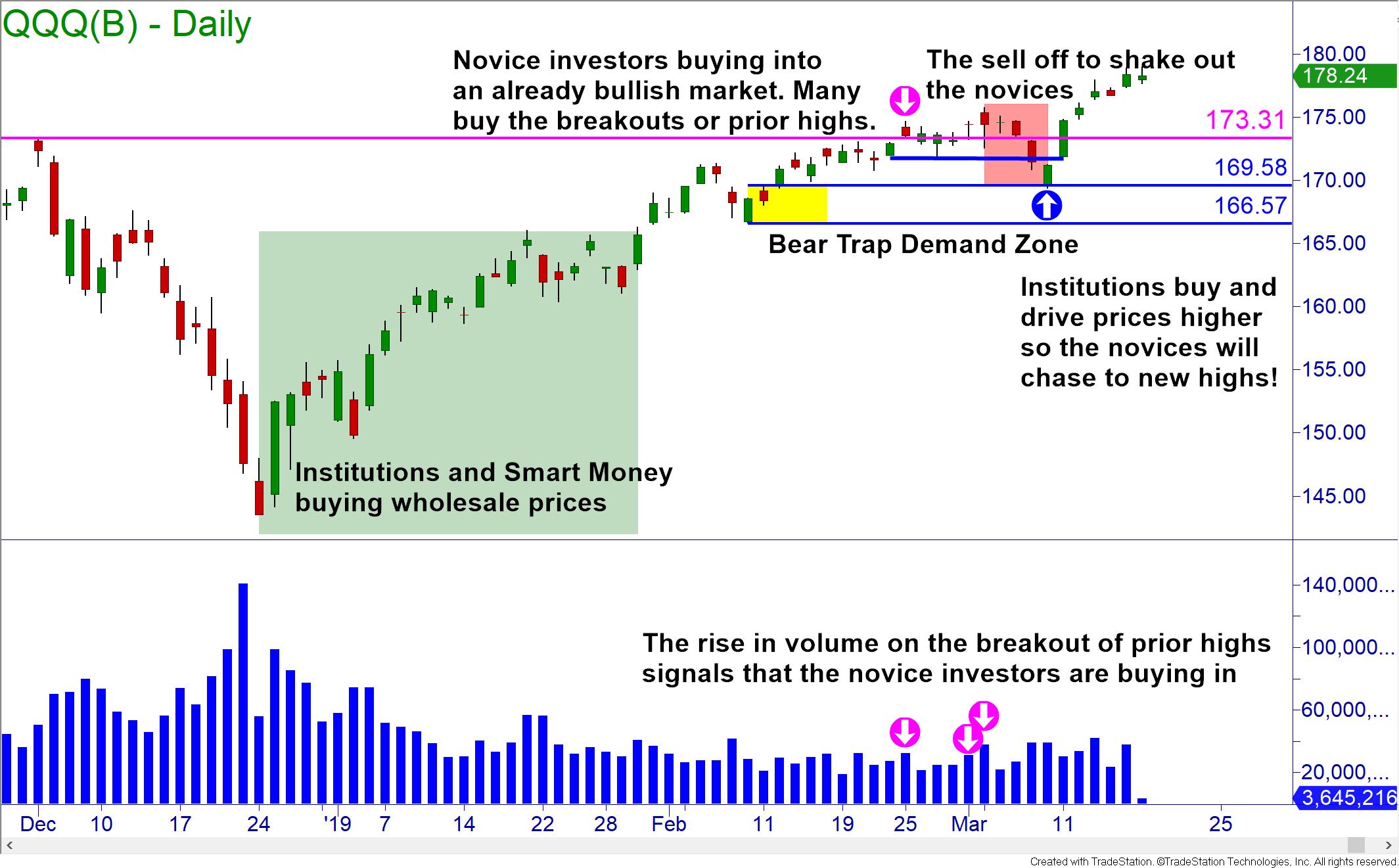

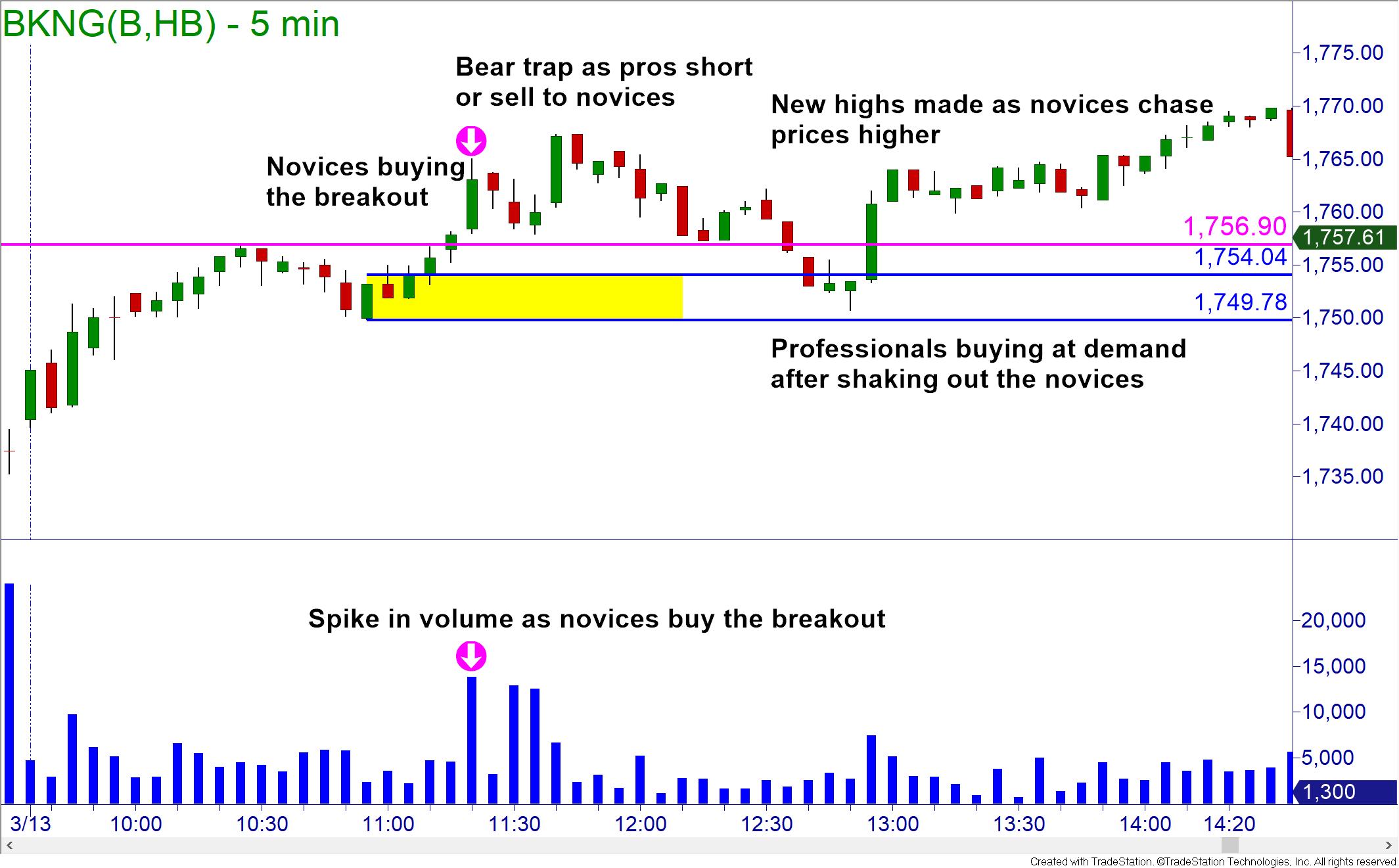

The same setup is usually observed prices breaking out to fresh highs where institutions will sell or short sell to the novices buying. Bear traps occur when investors bet on a stocks price to fall but it rises instead. Support Level Bear Trap.

The value of the coin then rebounds and the trap setters have made a profitBear traps originated on the stock market. This is what happens when a stock or other security stops dropping and unexpectedly begins rising. Typically betting against a stock requires short-selling margin trading or derivatives.

This pair had formed a support level at around 125 as it retraced lower and then bounced higher to 128 from there. Bear trap trading is the unanticipated behavior of a stock that lures bearish investors into false positions that can hurt your portfolio. Then when the price comes down due to heavy selling volume retail investors swoop in to purchase shares at a discount in bulk which drives.

It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward. A Bear Trap occurs when a stock that has been declining suddenly reverses and starts to rise. Most traders commonly dont know how to trade bear traps or when theyre.

Bear traps on stocks can also be found on intraday charts. Trading Bear Trap Explained. As we can see GBPUSD is trading on a bullish trend on the daily chart.

MC30 is a curated basket of 30 investment-worthy. An accumulation of shares being sold short by bears trying to drive down the price of a stock. It is a false indication of a reversal from an uptrend into a downtrend.

Its an advanced trading strategy and isnt appropriate for most investors. What is a Bear Trap. Institutional investors may seek to stimulate interest in a stock which encourages retail investors to sell and take profits.

They can occur over several days or within a matter of hours and begin when. Bear trap trading is also commonly associated with institutional investors. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively.

Invest In MC 30. The unsuspected traders considered bears would try. The bear trap occurs when the bears find they must repurchase the shares from an individual or a group at an artificial price determined by the seller.

Start browsing stocks funds and. Vladimir Putin can still shock the market at any time and investors havent fully grasped what it will take to rein in the worst inflation in. Many investors who have been watching the stock decline will sell it at this point because they believe that the trend has reversed and the stock will.

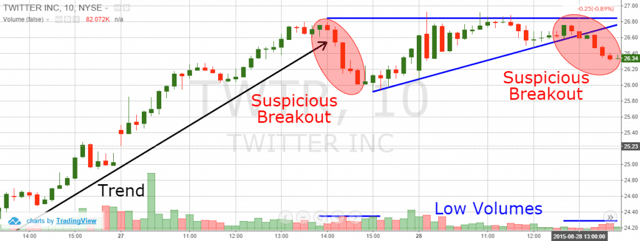

Selling a stock short is highly speculative and high-risk. Essentially the bear trap is designed to. A bull trap is a false signal indicating that a declining trend in a stock or index has reversed and is heading upwards when in.

When prices in an uptrend abruptly drop a bear trap follows. A bear trap is the opposite of a bull trap.

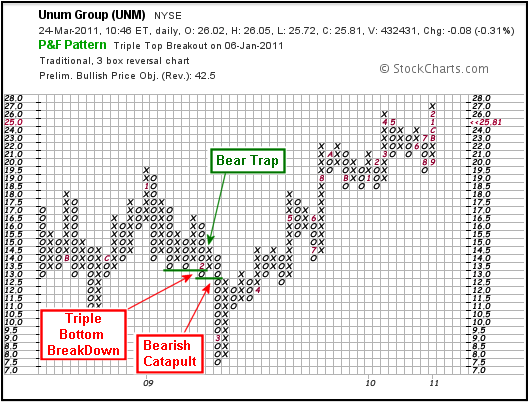

P F Bull Bear Traps Chartschool

What Is A Bull Trap In Trading And How To Avoid It Ig En

Bear Trap Stock Trading Definition Example How It Works

What Is A Bear Trap On The Stock Market Fx Leaders

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market

What Is A Bear Trap On The Stock Market Fx Leaders

The Great Bear Trap Bull Trap Seeking Alpha

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap On The Stock Market

Bear Trap Explained For Beginners Warrior Trading

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bear Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape